Wednesday, October 6, 2010

September Slump

September is historically a month when the stock market takes a hit. Unfortunately (for me) this September defied history and S&P500 climbed steadily more than 100 points. Unfortunately, this coincided with the time when I stopped paying close attention to the market and ended up taking some hits. As I look back, I can see that all my signals were there and had I followed my trading system, I would have profitted even though my bearish outlook was incorrect.

Oh well, lessons learned. For now, I have a lot of cash just because I am unsure as to what the market is doing. We broke the 1145 resistance I had been holding on to but my indicators are not giving bullish signals yet. The shorter term charts are bearish while the longer term ones are bullish/consolidating. See the chart below. An interesting point to watch for is the fact that the downward and upwards channels have created a confluence zone right above the current price. I think the market is going to test these trend lines and whichever side the price breaks to is the side to bet on.

Virtual Account

Since I am not a full time trader, keeping up with the signals spit out by my heat map was overwhelming. At one point I was up nearly 10% on the account (of $100,000) in a matter of 2-3 days but because I was unable to liquidate when the signals showed up(due to negligence), I did not capture the profits and now I am down 7%. Clearly, I need to either dedicate all my time to this or develop some sort of automatic trading system.

So, that is my next project. I have already refine the program to spit out buy/sell signals instead of TD studies' counts. The program needs some refinement and then eventually I am going to set it up so it can put through automatic buy/sell orders.

-Wown

stockjockz.blogspot.com

Thursday, September 23, 2010

Market Update

SP500 reached a high of 1147, a fibonacci level I had identified previously, and closed 25 points lower today. I missed that boat until this morning. But I do believe we are headed lower. My last two trades have been closed for small losses because the reversal I predicted did not come. The signs are all there, I think it is just a matter of time.

Virtual Account

Using the heat map, I identified a few opportunities last week. I shorted JOYG, BIIB, and VZ last week. VZ and JOYG got stopped out for a loss while BIIB is still an open position.

This week, JOYG remains as a possible sell position. Additionally, GILD is an excellent sell candidate. Also on the sell watchlist are:

AAPL

CHRW

DD

AMZN

No buy prospects this week, again.

-wown

Stockjockz.blogspot.com

Monday, September 13, 2010

Trade Update and Heat Map Update

In my previous post I said I was expecting a reversal on 9/7. On 9/8, SPX fell aroudn $11. But over the next couple of days, SPX rose, broke the 1104 resistance and closed today at 1121.90. Luckily, I closed out most on my position on 9/8 and closed the entire position out for around 15% profit.

As far as what's next, I think this is a fake break out and we are still due for a reversal of some significance. Reason being that we created a double top today just below 1125, another resistance level I have stressed in the past. Additionally, all my indicators are showing bearish signs. I think we might ahve an up day tomorrow before selling off for the rest of the week. However, I am waiting for a confirmation (on either side) before making any bets. I will keep you posted.

Heat Map

After many months of delay, bug fixing, errors, and frustration, the heat map is FINALLY complete in its entirety and ready to use. I have been testing this version for a week on the DOW 30 and NASDAQ 100 and have not seen any errors as yet.

Note: if you are unfamiliar with TD studies, I suggest a google search on TD setup, TD combo, and TD sequential before reading on.

This version features:

1. An accurate TD Setup Buy/Sell counts

2. Accurate TD Sequential counts (With an option to make aggresive counts)

3. Accurate TD Combo counts

4. TD Support and Resistance levels (when 0, it is N/A)

5. Count refresh on market close each day (so, unfortunately, it cannot be used for intraday trading. Perhaps the next version will include this feature).

I plan to test a trading system using this heat map by setting up a virtual account of $100,000. Every day (or as much as I can :) ) at market close, I am going to filter the table for those stocks hitting one of the following criterion:

1. 9 or more on Buy/Sell Setup

2. 12 (only because I am noticing that often price reverses at 12 rather than 13) or 13 count for sequential.

3. 12 (only because I am noticing that often price reverses at 12 rather than 13) or 13 count for combo.

I will analyze any of the stocks hitting TWO of the above criterion (within a 5 bars of each other) and see if the stock is at a Fibonacci convergence level.

If, so, I will, trade ATM options (in the direction that the study predicts) for a position size nearest to $5000, setting a stop loss of $1000 (or above Fibonacci level, whichever is less) and target of the support/resistance as stated by the heat map.

My exit strategy will be to sell 50% of my position when we reach 50% of the way to the target and move stop loss to breakeven for the rest of the position. Otherwise, sell another 30% at target and set a trailstop of 5% (on the option) for the rest of the 20%.

At any given time, I will hold no more than 5 put and 5 call positions and no more than $20,000 invested.

Be on a lookout for a weekly update of what stocks are on my watchlist that week and a summary of last week's performance. I have a strong feeling that the system will work well - if not at least I don't loose anything. Today's update is below:

No immediate trades but the following could be potential Put trade opportunities:

1. QCOM: 7 on Setup and 11 on Combo mixed with a declining oscillator right around an important Fibonacci level makes buying puts on QCOM quite attractive. However, we did recently break downward Fib. channel meaning that this could simply be a small retracement.

2. VZ: Similar situation as QCOM.

3. BIDU: Approaching the top of a channel that BIDU has been adhering to for a while now.

4. BIIB: Hit 13 almost in junction with a setup completion after a lot failed perfection attempts at completing the sequence.

-Wown

stockjockz.blogspot.com

Wednesday, September 8, 2010

My Views on Trading Implied Volatility vs. Price

a) I am not as good at trading IV.

b) When you trade IV, you are essentially trading price so keep things simple and trade price.

Below is a more technical explanation of the above two statements.

Conversation on InformedTrades.com

I post a copy of this blog on InformedTrades. The following conversation took place between myself and another user (Forexer) on InformedTrades:

Forexer:

Here you about volatility. You think volatility follows the normal distribution? Price doesn't. Price is lognormal. They have skews very frequently and that is exactly what makes them tradable. I rather sell volatility than buy them because high IV usually erodes slowly at the least or maybe revert back to the mean. We can use statistics in trading volatility to a great extent. But we know its not all about volatility

Me:

Volatility is supposed to follow a normal distribution from what I understand. Reason being that the means of multiple lognormal distribution should be normally distributed. Since the means of the multiple lognormal distribution is basically what volatility is, we should conclude that volatility is normally distributed (correct me if I am wrong - been a while since I studied option theory).

But like price, I would argue volatility too should be lognormal because although volatility is supposed to measure the increase in price movement, [implied] volatility rises when price falls and vice versa. So IV really isn't measuring the variation in price but rather the market's belief or reaction to negative price movement. So, since price distribution can be skewed and volatility is simply the reaction to price movement, it too should be skewed.

Which brings me to my original point: if you trade IV's, you must take into account the fact that negative price movement will raise IV. So, you should long IV when you expect price to decline and vice versa. But why would you go into such complicated calculations when you could simply trade the price in the first place.

Hope all of that makes sense

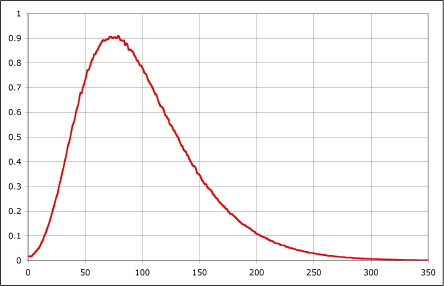

Let me explain that a little bit. A lognormal distribution looks like the graph below:

Source: danvk.org

Source: danvk.org The reason for this lognormal distribution is quite intuitive. The price can never fall below zero so the lower limit is set at zero. The upper limit is infinity however realistically speaking the price will be centered around the mean (which in this case is around 75).

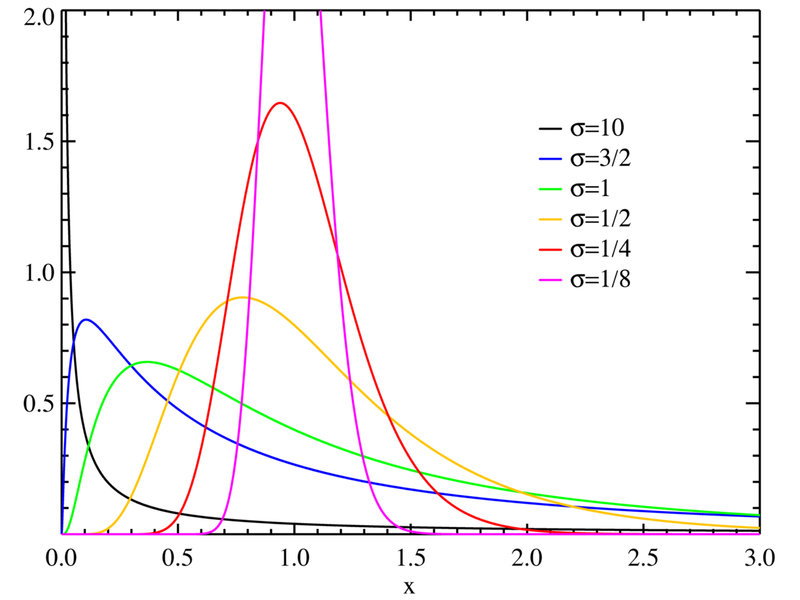

However, different set of price data for the same security can have a different lognormal distributions. The difference in this variation arises from variations in the mean and the standard deviations. For example (only illustrative), in the month of August, SPY could have a mean of 110 with a standard deviation of 10. In August, however, the average was 105 with a standard deviation of 20. These two data sets would yield two different lognormal shapes. This is illustrated in the graph below:

Theoretically, the means (averages) of all these lognormal distributions will have a normal distribution. In other words, if you created a data set of the means of all of the lognormal price distributions of a security and plotted it, the distribution would resemble the below:

Theoretically, this normal distribution is the volatility of the stock. But all of this seems counterintuitive to me. For one, remember that a normal distribution does not have a lower limit. So essentially you are allowing for negative prices - even if the chances are one in a billion. Additionally, and this is simply speaking for experience, IV tends to fall a lot slower than rise and this is clearly not represented in a normal distribution. Thus, there is a BIG disconnect in what IV actually is vs. what it theoretically is.

In my mind, IV is simply another way to say what the option's price is - which itself is simply a derivative of time value and underlying's price. Theoretically IV is supposed to imply how much the market believes the stock will move by expiration, but in truth, I believe it simply says "how afraid are people that stock will fall". The more afraid they are, the higher the IV (yes, even the call IVs - although this is often overlooked simply because the falling price deteriorates the price of calls).

Continuining with the coversation from above:

Forexer

Yea. Hats off to you. I'm not a math guy but i hear you on the IV being lognormal. Does IV increase on large updays?

Short answer: No. If anything IV falls on large updays. Take a look at the chart below of the SPY:

The chart shows SPY price plotted with average implied volatility. Granted this is not a very thorough study of IV vs. Price, but you can clearly see:

a) IV rises a lot quicker than it falls.

b) Price and IV are negatively correlated (When price rises, IV falls and vice versa). Notice the price vs. IV from Feb to May and then again from late June to August.

-Wown

stockjockz.blogspot.com

Tuesday, September 7, 2010

Another Reversal

Meanwhile TOS updated its software and in the process all my charts were erased. So for a while there I was trading on gut instinct because TOS support claimed that the charts would be available soon.

On Friday I finally contacted TOS support and asked them the status. Turns out you can reverse an update and that is exactly what I did. When I got my beloved charts back I saw that SPX was trading just below 1105 resistance I had found a while ago. Not only that but the Demark countdown and setup hit 13 and 9 respectively. I quickly liquidated my long calls and now I am sitting on a put vertical. I expect the price to drop to at least 1080. However, I may be inclined to cash in the profits (currently at 4%) if the oscillator breaks the downward trend (see red line).

In other news, I am going to try increasing my position sizes. My performance and price reversal predicitions have been very accurate lately and I believe it is because I have finally found a combination of fibonacci trading techniques and indicators that work. So, feeling more confident, I am going to increase my risk apetite. Also, most of my trades have some sort of an 'insurance' policy now where even if I am wrong, I have a counter trade that at least helps me break very close to even. Of course, I am still keeping my positions and max loss at around only 4% of my account.

Finally, I have been considering what has helped me perform better lately (Compared to 8 months ago when I was down 20% of my account). First, I am not trading news anymore. By the time retail traders get wind of the news and act on it, it is almost always too late. It is also no use trying to predit the news because again, if you are making a prediction, you can bet a lot of others are as well and acting upon it.

Secondly, I have been sticking very strictly to my trade plans - taking emotion completely out of the picture. It is tough watching your trade take a 50% hit and having the patience to let it play out. I think I have finally managed to learn that lesson.

Finally, I realize that I am terrible volatility trader. Many experts out there claim that if you trade options you must trade the implied volatility. Also, they claim that since volatility usually operates within a given range, it is easier to predict. I say all of that is a bunch of crap. You have to know the direction of the move unless you are 100% delta neutral (Which is theoretical anyway) all the time. Maintining neutrality alone costs a fortune in commissions.

Additionally, and maybe this is just me, predicting volatility is just as hard, if not harder, than predicting price direction. Reason being that IV is a derived mathematical and theoretical number to which you cannot assign technical studies. So, I feel people are better off just taking advantage of the leverage properties of options to trade the underlying.

-Wown

stockjockz.blogspot.com

Friday, August 6, 2010

Revisiting Old Friends: Told You So

I got to work and checked the futures and to my surprise, the futures are now DOWN $10!

All I say is "Told you so" and scratch my note.

-Wown

stockjockz.blogspot.com

Wednesday, August 4, 2010

Revisiting Old Friends

Who knows - all I can say is that we will probably make a sizeable move one way or the other and so I am setting up for a trade to capitalize on that.

A couple of interesting points on this chart:

- Firstly, notice how well the chart has followed the blue fibonacci channel. I drew this channel back on July 19th. The accuracy of the support and resistance points is uncanny - still amazes me. Anyway, the point is that I see the market trying to break the resistance but really not able to do so - giving a bearish indication.

Do not forget, however, that this is an upward sloping channel thus indicating that we are in a bull trend (on the 15 minute chart at least) and we may simply be in for a correction before a rally (or perhaps the correction already occured and once we break the resistance its a bull-run!). - There have been multiple sell signals on the DeMark indicators. Additionally, the top of market failed to reach the top of the channel, indicating that the market may be contracting. Again these are bearish signals.

The same chart on a daily time frame shows an even bearish picture. Firstly, please excuse the light gray channel on the chart - it is the channel as shown in the chart above. I would have liked to simply hide that channel but TOS will not let me hide a single channel.

Getting back on track, you can see that 1125 has held its resistance for three days and now we have approached the top most leg of the downward sloping channel. IF we were to break this channel and break the 1125.75, it would be a very bullish signal. However, seeing as how the EW pattern seems to have played out in a perfect 1-2-3-4-5 and that the oscillator has been trending downwards while the market is rallying, I have serious doubts that we can break this resistance without more buying pressure.

When I started writing this post, I felt I had a neutral outlook on the market. However, I sound very bearish in this post. Originally, I was going to trade a straddle with as high (least negative) a theta as possible. Instead I think I will go with a put diagonal (I believe that is now my most frequent trade). If we break 1125 and the channel top, at least I can sit on short puts until they expire.

The Heat Map/TD studies filter

I have had a couple of questions on the update for the heat map/TD studies filter I have been working on. Unfortunately, I have not had the chance to work on that at all. Suffice to say that one point I had everything working but then realized it was quite buggy. I am still trying (well not really at this moment, but soon will try to) figure out the cause of the bug.

-Wown

stockjockz.blogspot.com

Tuesday, June 29, 2010

Market Commentary 6/29/2010

I did just that - bought a Put diagonal when SPX was trading at around 1094 (see chart - the blue circle). Of course since then we dropped significantly and bounced off the 1040 area that I said would prove to be the support. Not surprisngly, the sequential hit 13 today on the 15 minute chart.

However, the trend is still very much bearish. Look at the fibonacci channels in the chart - it shows the market is still very much within the bounds of the channel and the lines have not broken.

Keeping this in mind, I sold half my diagonal, capturing ~21% profit. I am now sitting on a diagonal with very high theta. If the price consolidates or continues falling, I anticipate making ~40% profit. Meanwhile, I am keeping an eye on the daily oscillator and setup count (Which has reached 7 already). If that turns bullish, I will tighten my stop loss and exit the entire position.

Additionally, take a look at the table below. In ninjatrader, I finally have setup working to perfection. Sequential and Combo studies are nearly there as well, just needs some tweaking.

The colors really help you see when the trend is reaching exhaustion. For example, notice that most stocks are showing up as green while only a couple are red. This means that the bear trend may be ending soon. I can also filter the table so that I only see stocks that hit a 8/9 yesterday.

-Wown

stockjockz.blogspot.com

Tuesday, June 22, 2010

Feels good to be right!

The new retracements and expansions confirmed the 1104 level. I found a new confluence zone at 1125 area that could prove to be stiff resistance.

The SPX topped at 1131.72 (a mere 6 points off) and fell around 3% in a matter of a day and a half. Not only did we have a fairly dramatic sell off, but we closed today below the 1104 support that I have been stressing.

As far as trading strategy, I have been taking small profits along the way down but the sell off occurred so quickly I did not find a good entry point. Moving forward, I am going to wait on a confirmation of the 1104 breakout to the botton on the daily chart. I think we could rebound a little tomorrow and test the 1104 area before moving downwards again. If this occurs, I will take a large short position with a price target of 1040 and a stop loss at 1125.

-Wown

Stockjockz.blogspot.com

Thursday, June 17, 2010

1104 the support now?

However, today I suprised myself at how much my perspective changed in just a couple of added days on the same chart:

Firstly, the two days that we registered (keep in mind today is not over yet) above 1104 have both been down days. This indicates that the breakout is fake and we could reverse yet. Secondly, notice that the TD setup has reached 6 meaning that the potential bull rally is over in 3 days. Third, the oscillator has reached overbought territory further indicating an exhaustion of the bull run.

So I decided to pull one of the older tools in my arsenal: Fibonacci levels. I have not used these for a while. My first observation came as no surprise: the new retracements and expansions confirmed the 1104 level. I found a new confluence zone at 1125 area that could prove to be stiff resistance.

Finally, my monthly oscillator is taking a dive from the overbought area indicating that this may be simply a correction in a much larger bear trend.

So here is my hypothesis: we will continue to rally to around 1125 area and then go right back down. I think I will wait for the confirmation of this move to come around before I make any major trades.

In the meantime, I think I may switch brokers to Tradestation. Their platform allows for much better custom studies and more importantly much better screens. Not to mention their commission rates are lower. My only concern is the whopping 7% margin interest rate which would be a pain.

-Wown

stockjockz.blogspot.com

Monday, June 14, 2010

Retested 1104 and failed

Today I thought we might break the 1104.7 resistance for the S&P500. There was a break on the daily downward trend (blue line) that has been holding up for quite a while now. Early afternoon today we also broke the 1104.7 resistance I have been stressing for a while and I ALMOST took a long position on the S&P500 (I have liquidated by short positions I mentioned in my earlier post).

Instead, I shorted the market and took a small profit as the market retraced. However, I am out of that position as well because I think we can still break the resistance. Already the selling pressure is abating and as I am typing my oscillator is turning positive. I think that during this week we can see a confirmed break out above 1104.7 but it could come after a couple days of consolidation around that level.

My GS short calls and SPY short puts are nearing expiry, both OTM. The SPY is a near guarantee while GS still has around 3% chance of going ITM. I am reading The Black Swan at the moment and so I believe the 3% is definitely a risk. I am considering getting out of that position, especially if the SPX breaks 1104.7. I have already made a 95% profit on that trade and now I am just being greedy.

- Wown

stockjockz.blogspot.com

Wednesday, June 2, 2010

Short on the market

I believe for the moment we are in a bear trend and even as today we are up ~1.60%, I think we can expect a few more weeks of sidways or downward movements. I am watching the resistance levels established by the market (S&P 500) at 1218, at 1170, at 1107 during the up swing from Feb to April. Since mid-April, when we started going downwards, the market rebounds, hits or approaches these levels and falls down again.

So, keeping that in mind, I am short on SPY. The only 2 things on my books right now are:

1. Short calls on GS at 170 expiring in July

2. A put 101/108 June/Sep diagonal (got very high premiums for the 101 puts so worst case scenario I get stopped out for the Sept puts and still make profit).

Still working on that spreadsheet, although slowly. The more I read about the study the harder it gets to program the damn thing...

-Wown

stockjockz.blogspot.com

Sunday, May 9, 2010

What a week!

I was very busy with work so even though my indicators started showing bearish signs on Friday 4/30 and also Monday, I did not set adequate stop losses and took some pretty big losses on Tuesday. I thankfully managed to get out of a lot of my positions by the time the big "crash" hit. But I still had some long positions and as it happened, I was driving around and internet-less that day.

As things started going bad, my buddy was texting me the dramatically falling prices. One text simply said "its a crash. down 900" and this triggered a panic attack for me. I was sitting in a car FREAKING out thinking "Oh my god! I may have just lost everything!".

Luckily the market came back and I had short positions on GS and QQQQ so my losses that day were not that great. What really took me out was a case of the fat finger on Friday. I was watching the markets and mid day Apple showed bullish indications. So I decided to take a long position by buying ONE call option. Accidentally, however, I bought TEN calls. So, I said "that is fine, I think it is going up".

And Lo and Behold, Apple rises ~$3! Jubilant, I check my position and see that I am DOWN ~$2000. Thinking that there must be widespread falling IV's because of the rise and the delta effect has not kicked in yet, I hold on to my position. My losses just keep going up, however. At -$2100 I realized I had bought TEN PUTS instead of ONE CALL!

As a result, I have now decided to take a break. I need to develop a more solid trading plan and always set firm stops.

I am working on using TD indicators. Below is a screenshot of a spreadsheet I am developing:

The spreadsheet can download 10 years' historic data for the stocks listed on the left. It then calculates TD Setup numbers on daily, weekly, and monthly charts. I plan to add TD Sequential and Combo as well to the table and finally add PLDot numbers.

I can then use this as a screen to find stocks breaking trends on the PLDot and combo completion.

-Wown

stockjockz.blogspot.com

Wednesday, April 21, 2010

Chart Series: BIK

Comments

I bought BIK thinking of it as a long time investment (5 years or so). But I have lost around 10% on this investment so I went out of it. I still think fundamentally the BRIC sector has a lot of potential over the next 5-10 years (although there are concerns about China showing signs of slowing down and letting the yuan float which could hurt chinese stocks).

So I went back and looked at the index technically and realized I bought it at the top of a correction (d'oh, should have checked techincals before buying!). BIK is in a bear trend at the moment daily, moving sideways on the weekly, but on the monthly if we can close above the PLDot, a new bull trend will be established. If the weekly and the daily charts can follow up (which needs to happen anyway for the bull trend on the monthly to occur), I will buy back into BIK.

Also, I am keeping a close watch on the composite oscillator, looking for signs of reversal. I think the oscillator has reached about as low as it will go so should turn around soon. We are reaching a very key support at 24.7 which could very well be the turning point.

Tuesday, April 20, 2010

Chart Series: DIS

Comments

I bought DIS as a long term investment a while ago and the bullish trend has continued for a while. The stock, on the daily chart, is consolidating pre-earnings but is still showing support not far below the current price. My target is around $43 for DIS because of the bullish signals on the weekly and monthly charts.

Not to mention I think the FIFA world cup and acquiring the Marvel franchise helps disney fundamentally quite a bit.

My Trade (Investment)

long 300 shares of DIS.

Chart Series: TLB

Comments

A strong bullish trend on both weekly and monthly charts suggest the TLB is going to climb upwards. Although there are some bullish signs on the daily chart, I think any bullish move will be short lived because from an EW perspective I think we are in the middle of or end of a wave 1 (which would mean a wave 2 could pull back the gains a bit, but not below $11).

There is very strong support near $12.80 and both, PLDot weekly and daily support are above this level.

My TLB Trade:

Short 12.5 Aug Puts.

Charts Series: AAPL

Comments:

In the short term Apple is looking bearish as the PLdot trend is broken (price closed below the PLDot line yesterday followed by an opening on the down side today). Also the Composite index is looking bearish because of the divergence in the composite index tops.

Having said that, weekly and monthly charts are looking very positive - PLDot trend is very strong on both and the composite index is on a bullish run.

From an EW perspective, I think we are in the middle of a wave 3 or wave 5, depending on how you look at it. Thus it is possible the short term trend reversal will feed into the longer term trend reversal.

However, I think the reason for the consolidation in the short term chart is because of the earnings release on 4/20 (Today!). I think AAPL still has some ways to go further north, especially since the Monthly PLDot resistance and Fibonacci resistance is so high. Also, there is very strong PLDot and Fibonacci support in the 230 area, so I doubt AAPL, if it falls, will fall far.

My AAPL Trades:

May 240 Calls - left over from a straddle

230-220 Bull Put Vertical

Will post more charts.

-Wown

StockJockz.blogspot.com

Friday, April 16, 2010

A Few Updates

DG Bull put

The trade worked out quite well. The earnings were somewhat disappointing and DG briefly gapped down. But the overall momentum of the market had the stock rebounding back up in no time and the combination of the positive deltas, high thetas, and dramatically falling implied volatility has made all the options worthless at this point and so I have achieved my maximum profit (unfortunately I am unable to get rid of the trade because there is no market for it. I guess I just have to let the options exprire in May).

Profit realized: 200% ($160) on cost and 8% on margin.

AAPL and MSFT Straddles

This trade is not going as well as I had hoped. My trade's premise was based on the theory that IV would rise. I think the IV was so much higher than HV that it could not go further up quickly enough to counter the negative theta.

The puts were doing especially bad because the stocks kept going upwards. So, I have traded the puts away for a small loss. However, the calls that I kept have been doing quite well. Because today is a down day, my current overall position on both trades is pretty much breaking even. Hopefully moving forward, the stocks make positive jump and I can realize profit on both these trades.

Additionally, I have been slacking off on my QQQQ analysis. I actually accidently ended up deleting my charts and I have just been too lazy to recreate them. One of these weekends I will get time to do that.

Finally, I have been REALLY slacking off on posting my month-to-month performance so I will try to get back on track with that:

Mar-April profit: 3.58%

Most of my profit comes from bull put spreads as I ride the rally higher. Today worries me quite a bit actually because I am down across the board and lost 2% today. Perhaps it is time to consider exiting some of my position prematurely because a correction may be on the way.

Biggest loser was actually one of my long-term investments in BRIC countries. So I am not too worried about that one.

-Wown

stockjockz.blogspot.com

Tuesday, April 6, 2010

2 Trades: MSFT and AAPL Straddles

Buy 6 MSFT Strike 30 May Calls and Puts.

Entire trade at 2.25/contract

Buy 1 AAPL Strike 240 May Calls and Puts.

Entire trade at 21.30/contract

Analysis:

Both these tech giants are announcing earnings on 4/21 and 4/22. The Average implied volatilities are dwindling 26% for MSFT and 31% for AAPL. This is much lower than the average for both companies and the reason may be the steady bull run both companies have enjoyed since last earning season.

However, already implied volatility is starting to creep back into the market as earnings approach - investors are protecting themselves against a possible reversal in the trend post-earnings.

Expecting to see the age-old phenomenon of rising implied volatility in pre-earnings weeks, I have traded the above strangles. My worry is that theta is somewhat high for May options, but June contracts were too expensive and did not present the desired vega values. Additionally, the historical volatilities are lower than the implied, suggesting the IV could fall lower or stay the same. Theta deterioration and a lack of increase in volatility could hurt me.

Profit/Loss Expectations and Trade Management:

If implied volatility rises a mere 5%, I will make ~$300 on both trades (which is approximately 22% on MSFT and 14% on AAPL). If this happens, I will exit the trade aroudn 4/19 in order to protect myself from falling implied volatility post-earnings.

Also, depending on the time frame, if AAPL or MSFT move ~6% in either direction, I can expect to make a profit (the probability of this is ~45% for both trades). If there is a significant breakout in either direction, I will sell the other leg and retain profits on the winning side.

The worst case scenario would be that both stocks move right to the strikes I traded and settle there along with falling implied volatility. If this happens, I will exit the trade a couple days after earnings announcement.

-Wown

Stockjockz.blogspot.com

Monday, March 29, 2010

Trade: DG bull put spread

Sell May 22.5 Puts - 8 contracts at .30 each

Buy May 20 Puts - 8 Conttracts at .15 each

Resulting in a bull put spread with a limit price of .15/contract.

Analysis:

Dollar General options are trading with an average implied volatilities of around 36%. That is 12% higher than the average 20-day and 30-day historical volatility. The reason for this spread is that DG is about to announce earnings in a couple of days. Once earnings are announced, I believe IV will drop significantly, devaluing the short puts.

From an EW perspective DG is beginning wave 3 up and if the earnings are positive, the wave could continue upwards for a while.

If my EW theory is wrong, I have found very strong Fibonacci support at $24.30 and at $23.9. I highly doubt that DG will be able to break both those support levels even if earnings are poor. That is why I have picked strikes well below those levels.

Profit/Loss Expectations:

If I hold this trade to expiration, I can expect to make approximately $96 or 5% on Margin requirements (after commission) in under 60 days. Annualized, that is approximately 40%. I will achieve this profit at any price above $22.50 and there is a 73% chance of this scenario.

If I hold the trade until expiration and the price closes below $20, I will have the maximum loss of $1880. There is a 10% chance of this scenario.

Trade Management Plan:

If the price breaks upwards or keeps movings sideways after the earnings announcement, I will sit back and let the options expire after 53 days.

If the price breaks downward and below $23.20 (just below another Fibonacci level), I will exit the position with ~$400 loss after waiting a couple of days to see if IV falls. If at anytime my overall loss reaches $800 (~stock price at 21.20), I will exit the position immediately.

-Wown

Stockjockz.blogspot.com

Friday, March 19, 2010

3/19 update QQQQ

My reasoning is now that the original EW pattern I had drawn may have been wrong and I have discovered a couple of alternate patterns which could be developing. I still remain bearish on QQQQ in the short run, but now I am not sure about the long term trend - the bull market run may or may not be over.

Will post detailed analysis in a couple of weeks as I am very busy at the moment.

-Wown

stockjockz.blogspot.com

Monday, March 8, 2010

3/8 update on QQQQ

After consolidating for a couple of days at my initial target of 45.57, the QQQQ has continued to climb higher. This has two significant impacts that I have described below as I explain the chart updates.

Before I get into that, I do want to simply summarize the below so that if you are Elliott Wave challenged, you do not have to read on. Basically, I very strongly believe that this move up is coming to an end and I still think the next support level of the down move is near 40.50.

Chart 1(hourly):

The hourly chart shows that wave 5 continued to climb up, contrary to what I had originally suspected. After reaching the top of the channel (black diagonal line), QQQQ moved along the channel, setting a price high of 46.64 (again). Now if you refer back to my earlier posts, you will notice that the second most likely target I had set for QQQQ was exactly 46.64 (as reflected in the daily chart below, chart 2). This fact, coupled with the major divergence I am seeing in the oscillator and the fact that volumes are declining further, strongly leads me to believe that wave 5 is more than likely over.

The only alternative is that wave could extend and continue upwards. I find this unlikely because of 2 reasons. Firstly, the 5th wave extended in the previous motive wave up (wave A green). Thus it is likely that the same will not happen again.

The second reason is explained below as it needs us to look at the daily chart.

Chart 2 (daily):

The second reason why I believe that wave 5 will not extend is because that would put wave C (green) above the previous top. This would imply that a running expanding triangle is developing as the correction and right now we are in wave B (blue).

Now I realize that such a thing is a possible. But it is very unlikely in this particular instance because wave A/1 (blue) was 5 waves down. This means that the most likely wave pattern that will develop is a Zig Zag or a triangle of some sort that is part of wave 1 down of a wave level higher than the blue waves. Now we can safely assume that this is not a zig zag because wave B/2 retraced all the way to market high, so the only alternative is the triangle option, and running expanding triangles are VERY rare, especially those with a 5-3-x-x-x pattern.

One could argue that this is a flat correction, but again, unlikely because wave A (blue) was 5 waves down, and flats usually have a 3-3-5 pattern.

I hope I have not lost you, and if I have, once again to summarize, I believe the target for QQQQ is near 40.50.

As a further update, I will try including time studies on future charts to have an idea of when these moves should be completed.

-Wown

stockjockz.blogspot.com

Thursday, March 4, 2010

QQQQ update

Chart 1: Hourly chart. I think 3 was an extension followed by a wave 4 that tried repeatedly to break the 3's top but failed, thus making a triangle. 2 reasons for believing 3 was an extension:

1) 5 was an extension in the previous wave up (wave 5 of A Green) and thus we can say because of alternation 3 should extend here.

2) wave 3's top would lie above my fibonacci confluence zone, implying that 3 became overextended. So a lengthy wave 4 correction followed which will be followed by a short wave 5.

Notice also the grey boxes. On the left side the market moved sideways while the oscillator fell. Then the oscillator reversed as wave 5 came about but very quickly after that QQQQ fell nearly a dollar. A very similar set up has been created on the right hand side as during wave 4 the oscillator has fallen significantly, today (during wave 5) the oscillator reverses. If the oscillator reverses AGAIN, you can be pretty confident that there will be a pretty big move down (And that is when I get in!)

Chart 2:

Two important things:

1) If I am wrong about the original 45.57 target and we do not get a reversal soon, the next target is 46.64 - not only because it is the previous top, but also is an important fibonacci confluence zone on the weekly charts (not shown).

2) Notice the steady decline in volume during the ABC (Green) wave. This signifies an exhaustion in this up move.

-Wown

stockjockz.blogspot.com

Saturday, February 27, 2010

QQQQ analysis continued

Chart 1: Hourly chart showing a 5 wave move up (in light blue) that is part of a larger Wave A (Green) followed by a 3 wave correction (light blue) that was part of a wave B (Green). Light blue waves are sub divided into pink waves where relevant.

Chart 2: Shows a 5 wave (green) down move that is part of wave 1 of a new downtrend (Which seems to be the most popular belief) or wave A of a correction of the bigger uptrend. Combining long-term and short-term fibonacci levels, I believe the most likely most for wave c (green) is to 45.57 area. The top of C (green) will either be the top of B (blue) or top of 2 (blue).

Tuesday, February 2, 2010

QQQQ Fibonacci analysis

Here is a chart I made a couple of weeks ago practicing Fibonacci levels. I have left only the most important horizontal confluence zones.

Notice how cleanly QQQQ is bouncing off a VERY significant level (possibly the most important level in the entire chart - this level kept showing up as a confluence zone).

-Wown

StockJockz.blogspot.com

Update on AAPL

As mentioned in my previous post, I bought a put diagonal believing AAPL will decline in the coming days. This post is an update as to what happened.

After I bought the put diagonal, AAPL released earnings the next day. This had two effects:

1) I got stopped out of my long puts around the red rectangle for a pretty significant loss on the long put side.

2) The drop in volatility, however, made me pretty good profits on the short put side.

At that point I was expecting AAPL to continue to rise and so I kept the short puts and expected them to expire OTM, which would have resulted in ~80% profit.

But, AAPL quickly reversed and after consolidating a little bit at the support levels I had drawn, it continued to fall. I did buy puts again around the green rectangle, so essentially I am once again in a put diagonal.

Looking forward, the 190 support is holding up pretty well and AAPL is currently unable to break the 196 resistance I have drawn. However, I am seeing an ascending triangle which is generally a bullish pattern. This could mean that if AAPL breaks the 196 resistance, any downtrend would be negated. I would then be, once again, forced to sell my long puts.

A counter argument to the above is that the volume is quite low and falling. Also, on the longer time horizon charts (monthly and weekly), the Oscillators are VERY negative. On the weekly, the momentum is the lowest it has been in months and on the monthly chart, the oscillator has made the first bearish reversal since 2007.

Finally, a couple of companies upgraded AAPL to buy this week. Normally this would mean significant gains for any stock, but the lack of conviction in AAPL's upward movement definitely bodes poorly for the stock.

-wown

stockjockz.blogspot.com

Monday, January 25, 2010

Shorting Apple

Notice the three Fibonacci confluence zones marked by the three red lines. These are zones the market has respected in the past. Although they seem very close to each other, they help me set entry and stop loss levels.

My entry was at $200, the middle Fib level (we shot past that today so I actually got an entry at much higher price).

The top level is where my stop loss would have been had I gotten an entry at $200. I am still using the top the level as a guide and setting my stop just above it. I know that if the market breaks this level, I am wrong and it is time to get out.

The bottom most level is currently my target. Notice the double top at $215 and how the Oscillator makes a second bearish reversal right at the double top. This is indicating that along with the Fibonacci and the price indicators, the oscillators are also pointing to a trend reversal.

Weekly Chart:

First, notice how the oscillator has made the first major bearish reversal since June 2008. This strongly suggest that there could be a serious pull back in AAPL.

Also notice the same Fib levels from the daily on this chart. Trace back to end of 2007 and mid 2008 and notice how the levels I drew held up nearly perfectly (blue rectangles).

My only concern as I entered this trade was that the price was edging very closely to my stop loss and a couple of times I definitely thought I would get stopped out. Also today price rebounded ~5%. This means that the hourly chart is showing strength (Indeed there is a major bullish reversal on the hourly chart oscillator).

In any case, I have entered a Put diagonal which you can see below along with the risk profile:

As I finish writing this, APPL's more than 5% gain today has diminished to around 1.7%. This means that the strength on the hourly chart has now been negated and of course also means that I making monies. Good thing too because I have been on a losing streak and I needed a good break!

- Wown

StockJockz.blogspot.com

Friday, January 22, 2010

Long SPY Calls

My target is 112.12 as this was the resistance in the previous bounce and is also a Fibonacci confluence zone. If the stock breaks this level, I expect it to go back to 115 area.

Tuesday, January 19, 2010

SPY Reaching Resistance

I made this chart a couple of months ago and repeatedly the the Fibonacci levels I have drawn have been confirmed. Starting from the left, if you look at the blue ovals, you can see that SPY bounced right at the Fibonacci convergence areas. After four very clean bounces, SPY got stuck 110.5-111 which was major Fibonacci resistance area. It finally broke 111 as SPY hit the Fibonacci fan's 50% retracement. After that, SPY has climbed very cleanly along this line and has now finally (almost) made it to the orange rectangle which is the next major resistance.

Moving forward, I strongly believe that SPY will either get stuck between that orange rectangle or fall to 110.5-111 area. Seeing as how the market has become so inactive that I would call it boring, I suspect that we will probably move sideways along this level (also, another Fibonacci study I did showed that the market is indeed showing indications of continuing to move sideways).

- Wown

StockJockz.blogspot.com

Monday, January 18, 2010

Backtesting a trading system

Above is the chart with the system implemented and the signals it has given since March on SPY. As it stands now, if you followed this system, you would have made -17.72%. But this does not mean that this is a complete waste, and below I show you why.

First, I think the logic on the system is reversed. If you simply turn all the short orders into long orders and long orders into short, you would have returned 21.52% since March.

Of course this falls very shy of the close to 68% you would have returned had you simply bought in March and never sold. So clearly we missed the boat on some good opportunities such as in July, October, and November. This is something that I will try to fix and see if I cannot get the system to not miss such good opportunities. An important thing to note, however, is the fact that once you reversed the orders you lost money only twice over the last year, which is pretty impressive.

I think if the system were supplemented with Fibonacci studies, one could filter out the unimportant trades and even find ones that the system missed. This will allow us to fine tune the system. Below is a chart of SPY on which I have drawn several Fibonacci levels. Note that all the levels I have drawn are based on data prior to 4/14/2009. So essentially all the Fibonacci levels are drawn as if today was 4/14/2009. This also assumes that I have ignored any signals the system has given up to this point.

As you can see there is very strong support at $81.50 and $82. SPY reached this level on 4/21/2009 Referring back to the chart above, you can see that there is in fact a Short (or after reversal, a long) signal on that very day. So I would have said, “OK, time to go long SPY”.

At this point, I would also project my resistance levels which you can see on the chart below. This time all Fibonacci levels are drawn using data prior to 4/21/2009, the day I went long SPY. As you can see the resistance lies between 87.15 and 87.5. We reached this price on 4/30 and lo and behold, the system gives a sell signal on that very day. My return on this trade would have been approximately 6.6%.Unfortunately, I would have got out too soon because had I waited another week, I would have made another 3% or so.

The next buy signal I get is on 5/8. I would not enter this position, however, because Fibonacci is telling me that there is resistance at $91.8. A very similar situation occurred on 5/12 and again I would not have entered this position unless I saw that the price broke the resistance lines. Not surprisingly, SPY hit the resistance lines and then fell right back to the 87.50 area which we had identified as resistance (and has now become support).

Ideally, the system should have given a buy signal on 5/15 or 5/26. There was a double bottom at a very important support level and I would have definitely liked to go long at this point. Had I gone long using the Fibonacci information, I would have entered at around 87.50 and exited at 91.70, returning around 5%.

After this the system is quiet for a long time, which is unfortunate because right around 7/10, it missed a huge opportunity that Fibonacci would have caught and returned around 15%. Many other such opportunities are missed and most of the other signals do not lie on Fibonacci levels or give false signals.

I think after some fine tuning this has the potential to be a very effective trading system. I think that the indicators need to be set on a faster response. I realize that this will give a lot more false signals, but you can eliminate those false signals using supplemental studies like Fibonacci or EW.

I also need to analyze other securities and see how the system works on them. Will keep you posted.

-Wown

Stockjockz.blogspot.com