Hello all, I go under the alias as Market Mike. Some have read my posts over at

Stocktock while most have never heard of me. I do not daytrade the markets however I have been studying charts pretty intensely for almost 2 years. I do believe experiencing these bear markets have educated most amateurs like myself much more quickly than being involved in a bull market like the one from 2003 - 2007.

With that said I do not daytrade, or play around with this market because I'd be the first one to tell you it can hurt. I'm no expert in Elliott Wave nor am I an expert chartist but I do believe I can offer an opinion and hopefully point out a few things that you may have missed or at least summarize what the others are saying in a more clear way.

One of the most exciting parts of a volatile market is everyone's attempt at calling the extreme tops and bottoms. It is almost like a game, however it can be a very profitable one at that. I'm not here to play the game, but I do want to bring forward to your attention some analysis that I just got done with to show you where I think we are going next in the Equity Markets.

As I pointed out before, I enjoy trying to call the major tops and bottoms in the market because I believe if you have access to the right tools its not very difficult to come up with targets. In fact the March 666 low was a bit unexpected by some, but it was one of my many targets that I had come up with.

Moving on to our current situation. Obviously now we are all looking for when this market is going to top out. I won't get into details about fundamentals and the like, but I do agree we have gone way too far too fast and we are way overdue for a pullback. Elliott Wave predicts a high chance of making new lows, I'm not too sure about that yet, however I am sure we are due for some type of significant countertrend move downward.

1938 vs 2009 Lets first look at an updated picture of the 1938 DJIA Pattern vs the 2009 SPX. I was one of the first to originally find this pattern, and I'll be damned if I'm not one of the last to give up on it.

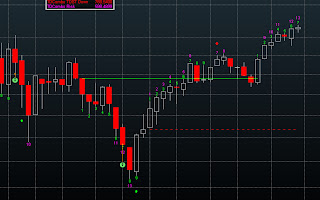

As I've pointed out in the annotations on the chart, there are still similarities that exist. Back in the 1938 there appeared to be a initial push, a pullback, and then a final exhaustive move to the upside. An A-B-C pattern if you will, finding resistance at each major Fib Retracement. Fast forwarding to today, the same thing is playing out. The timeframe is almost exactly the same as well.

The Importance of 1014The 1010 to 1020 level is some of the strongest restistance that I've ever seen. Typically when I look at technicals, I'm looking for multiple signals that say the same thing. I try to look at as many as I can, ones that everyone looks at and ones that everyone seem to ignore. However if they are all saying the same thing, it can only lead to one thing, a move downward (in this case at least.)

Exhibit 1: The 200 Monthly Moving Average and the 38.2% Retracement

One thing to take note, is that typically your major moves will retrace

exactly to a Fibonacci Retracement. This means a high will touch resistance within a few pennies, and a low will touch support within a few pennies. That is why when I see calls for anything between 1014 - 1121 I tend to shy away from it. However a close on the monthly timeframe is also feasible but less likely.

Exhibit 2: Basic Support/Resistance Levels and Trendlines - Rising Wedge (Bearish) Pattern

Although I forgot to include it in the chart. Anything simple thing to note is that Volume has been decreasing ever since we began rallying. Technical Analysis 101 tells you volume moving opposite to price is never good confirmation for a continued trend move.

Exhibit 3: Fibonacci Extension

This is one of those technical tools not too many people look at however they really should. In fact I couldn't even pull up this tool on Prophet Charts so I had to use TOS. If you consider this countrend move an ABC move, 1010-1014 was a target for the C leg, a 50% extension of the initial move.

Exhibit 4: Putting it all Together

Here is another chart I put together that has most everything that we've seen already. It also includes a Fibonnaci Arc that I've seen floating around. The bright green is line at the 1014 level is the 50% Arc, calculating from the Oct 2007 high to the March 2009 Low.

Lastly, here is one last chart that should convince you all. I accidentally came across it tonight as I was switching from log to normal scale. A chart of the outperforming nasdaq 100 reveals it has hit its trendline dating back to the 2000 high and also has topped out at the 50% retracement.

Now with all this said, I'm not willing to dump all my money going short the market because I could very well be wrong. However I do know I'll not be taken advantage of by this market if it does begin to plunge.